"If You Can’t Come To Us,

We’ll Come To You!"

Friendly. Understanding. Trustworthy.

"If You Can’t Come To Us,

We’ll Come To You!"

Friendly. Understanding. Trustworthy.

Welcome to Brown & Brown, LLP

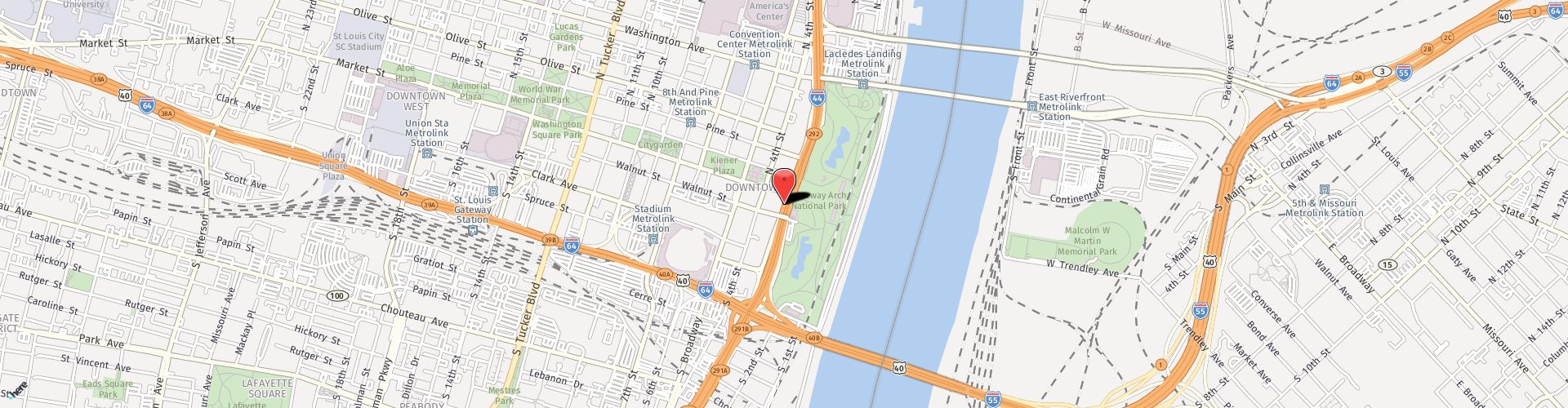

Injury and Accident Attorneys Serving St. Louis, Nearby Missouri, and Nearby Illinois

For more than three decades, the attorneys at Brown & Brown, LLP have built a reputation for success in the area of personal injury law. If you’ve suffered an injury due to the negligence of someone else, you deserve legal representation that provides the experience, resources and commitment necessary to help you seek the justice and compensation you deserve.

At Brown & Brown, we pride ourselves on our depth of experience in handling a variety of legal matters, from automobile accidents and workers’ compensation to and mass torts. Our skilled lawyers work tirelessly to attain the maximum compensation our clients need in the difficult times in which they are the most vulnerable.

As a family-founded law firm, we strive to serve our clients as though we were serving our own family. We take pride in helping each client with respect, integrity and a relentless pursuit of justice. Our firm began in St. Louis, Missouri. Over the course of 30 years, we have expanded to include a robust team of knowledgeable lawyers. If you live in Missouri or Illinois and need legal counsel you can trust to put your best interests first, please contact Brown & Brown today at 314-333-3333 or , or call us in Illinois at 618-888-8888. You can also complete an online contact form and our office will be in touch with you. If you can’t come to us, we’ll come to you.

100 YEARS

OF COMBINED LEGAL

EXPERIENCE

OVER 575

5-STAR REVIEWS

OVER 30

YEARS IN BUSINESS

Practice Areas

Meet Our Attorneys

Each of the experienced lawyers at Brown & Brown makes your case a top priority. We perform diligent preparation and research in order to protect your rights and pursue maximum compensation on your behalf. If you can't visit our offices, our attorneys will come to you.

From Our Clients

Might not be here today without their help years ago. Have recommended many others over the years to them. No one has ever had a bad situation.

After the shock wears off from an auto accident no matter how severe it was the pain & fear settle in. You need the experience only an attorney can provide. Brown & ...

Mr. Dan Brown took so much time collecting my data from doctors and hospitals for my case and was never too busy to talk to me. If I ever need ...

They really do go all out for you. Dan came to our house for quite some time and got to know my wife and I personally. I highly recommend Brown & ...

Was very pleased with their timely answering of the phone and getting me set up and explaining everything of how their business works to get me the best help and ...

The people I talked to at this firm were very helpful, they talked to me, not at me. Explained everything to me that I never understood before, I wasn’t ...

We’re Here for You

Brown & Brown, LLP has developed a strong track record of success, helping many of our clients recover the full compensation they deserve after suffering a severe personal injury. We believe that the keys to success are rooted in hard work and individualized attention. To our attorneys, you are never just another case number; you are an individual with a unique set of circumstances and goals. We will give you the meaningful attention you and your case deserve.

Our greatest pride comes not from our track record of success, but the real difference we’ve made in the lives of our clients. We believe that your personal injury lawsuit is about more than just money. Our top priority is getting you better. In that pursuit, our first goal is to ensure you receive the medical care you need. Then we work to help you get compensated for your injuries to the fullest extent of the law.

Latest News

Recovering Damages After a Spinal Cord Injury Accident

Types of Burn Injuries

Proud to Serve

Every month, Brown & Brown provides a check to be awarded to the recipient of Proud to Serve. Proud to Serve, a segment on Fox 2 News in St. Louis, highlights local heroes who have given both to their community and to their country. With strong ties to our community, Brown & Brown is proud to supports this recognition of men and women who have made a difference at home and beyond.

On The Road With Brown & Brown

Watch as our partners travel through interesting and beloved places in and around the St. Louis, MO and Illinois, IL areas.